The Caribbean tourism sector has shown remarkable resilience and growth, rebounding strongly from pandemic lows. With millions of visitors returning in 2023, both stay-over and cruise tourism have seen significant increases, driven by improved infrastructure and strategic marketing.

This post explores the latest tourism statistics, highlighting key trends, country-specific performance, and the economic impact of this vibrant region.

Overall Tourism Trends

Inbound Trips

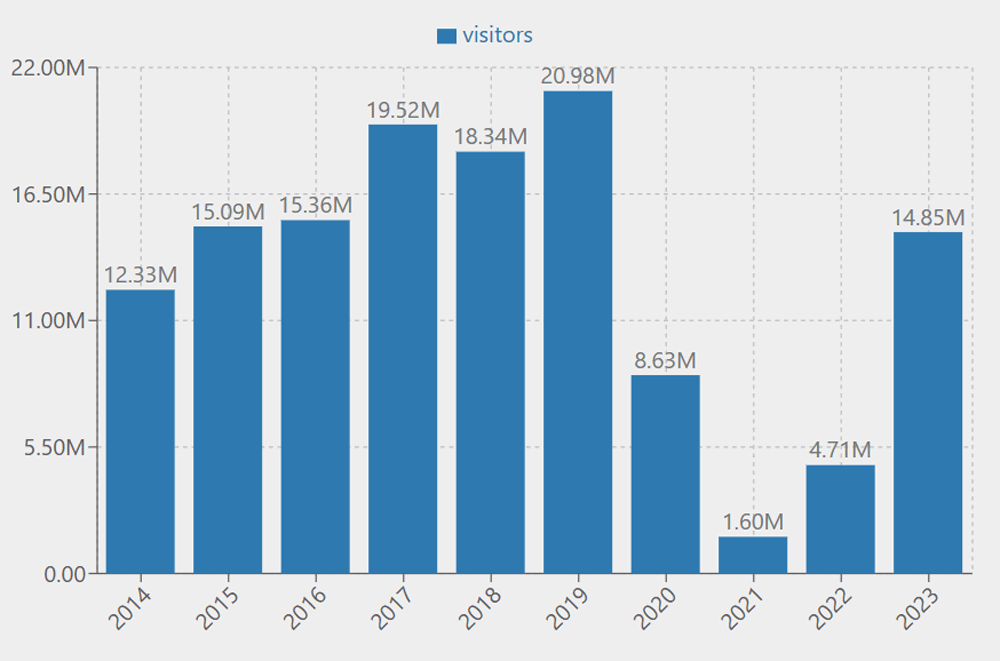

The Caribbean saw 16.46 million inbound trips in 2022, reflecting a significant recovery from pandemic lows, according to the Caribbean Tourism Organization. This resurgence highlights the region’s resilience and enduring appeal as a travel destination.

Growth in 2023

International stay-over arrivals increased by 14.3% in 2023, reaching approximately 32.2 million visitors. This growth is driven by enhanced travel infrastructure and strategic marketing efforts that have successfully attracted tourists back to the region, as reported by TravelPulse.

Cruise Visits

The region recorded 31.1 million cruise visits in 2023, marking a remarkable 56.8% increase compared to 2019 levels. This surge underscores the Caribbean’s status as a premier cruise destination, benefiting from improved itineraries and infrastructure.

Tourism Recovery

The Caribbean has experienced continuous growth over the past 33 months, steadily rebounding toward pre-pandemic levels, according to TravelPulse. This recovery is supported by strong demand, improved airlift capacity, and ongoing investments in tourism infrastructure.

Country-Specific Statistics

- Cuba’s Popularity: Over 4 million inbound trips in 2022 due to rich cultural and natural attractions.

- Dominican Republic Performance: Approximately 7 million visitors in 2023, recovering significantly above 2019 levels.

- Jamaica’s Employment Impact: Tourism accounts for about 37% of all employment in Jamaica, with increased tourist arrivals in 2023.

- Bahamas Employment Statistics: Tourism contributes to approximately 35% of total employment in the Bahamas.

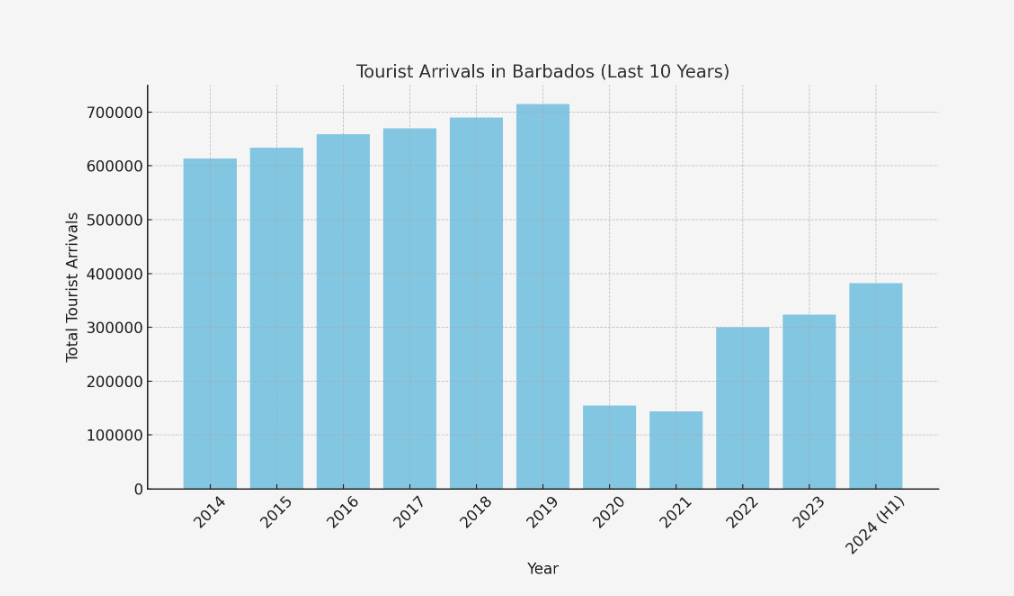

- Barbados Recovery: Welcomed over 1.2 million visitors in 2023, focusing on luxury tourism and cultural experiences.

- Puerto Rico’s Performance: About 1.6 million visitors in 2023, revitalizing tourism infrastructure post-hurricane.

- St. Lucia’s Appeal: Reported a 15% increase in arrivals in 2023, attracting eco-tourists and honeymooners.

- Grenada’s Tourism Growth: Estimated 200,000 visitors in 2023, focusing on sustainable tourism and culinary experiences.

Visitor Statistics

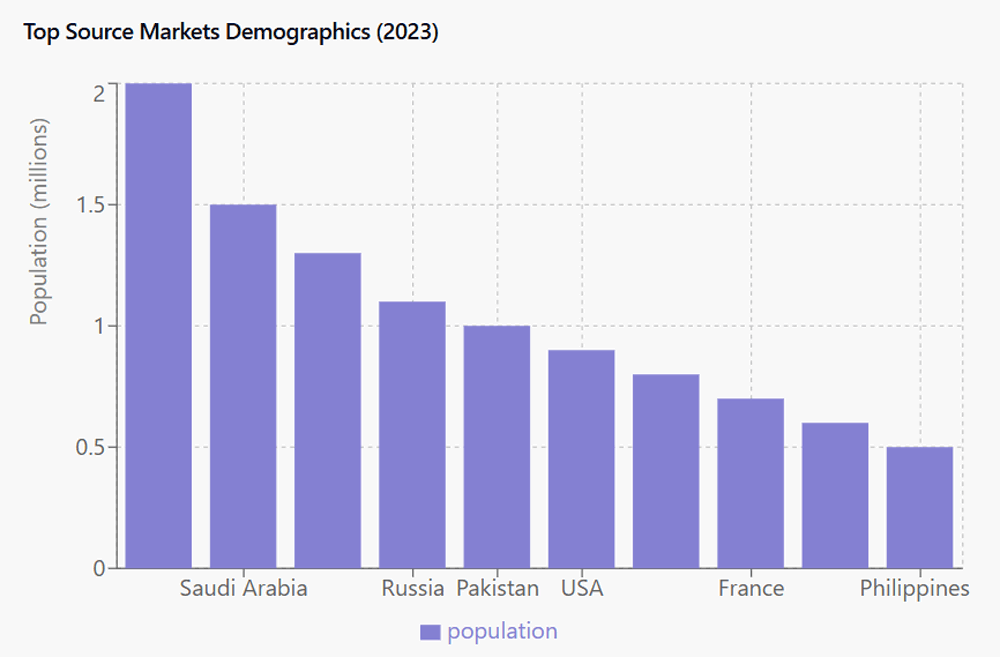

Origin Markets

- U.S. Dominance: Approximately 55% of tourists to the Caribbean originate from the United States, making it the largest source market for the region.

- European Visitors: About 20% of visitors come from Europe, highlighting its importance as a secondary market for Caribbean tourism.

- Canadian Tourists: Canada contributes approximately 9% of tourists, with a notable increase in arrivals due to enhanced air service.

- Intra-Caribbean Travel: Travel among Caribbean residents increased by approximately 3.6% in 2023, totaling 1.6 million trips, indicating a recovery in intra-regional tourism.

Visitor Spending

- Average Daily Spending: Visitors to the Caribbean spend an average of around $150 per day, which includes accommodation, food, activities, and shopping.

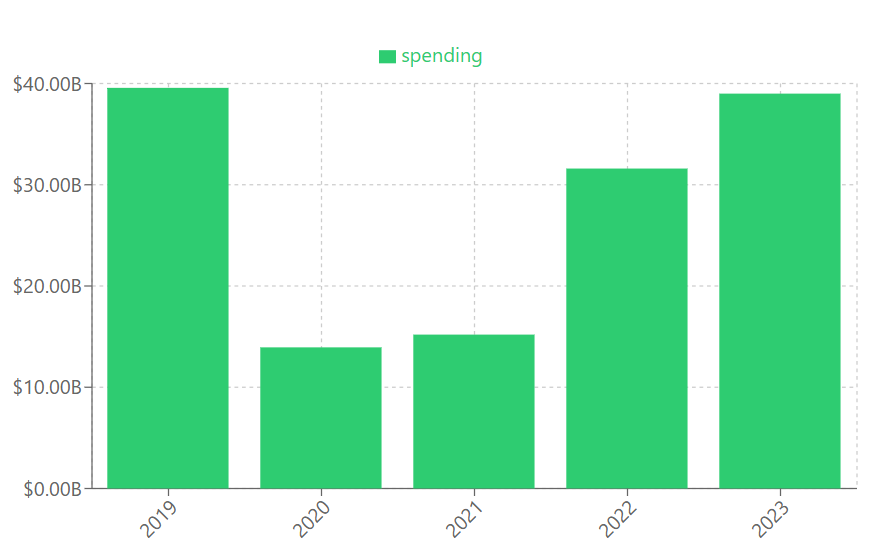

- Total Visitor Expenditure: In 2023, total visitor expenditure was estimated at approximately $39 billion, reflecting a robust recovery in tourism spending across the region.

- Cruise Tourism Expenditure: Cruise tourism generated approximately $4.27 billion in direct expenditures, about 27% higher than the previous record set in 2018.

| Year | Total Visitor Spending (USD Billion) | Percentage Change from Previous Year |

|---|---|---|

| 2013 | 32.0 | – |

| 2014 | 34.0 | +6.25% |

| 2015 | 36.5 | +7.35% |

| 2016 | 37.0 | +1.37% |

| 2017 | 37.0 | +0.00% |

| 2018 | 38.0 | +2.70% |

| 2019 | 39.57 | +4.14% |

| 2020 | 13.94 | -64.8% |

| 2021 | 15.20 | +9.0% |

| 2022 | 31.60 | +108.5% |

| 2023 | 39.00 | +23.8% |

Visitor Arrivals and Trends

- Total Arrivals in 2023: The Caribbean welcomed approximately 32.2 million stay-over tourists in 2023, marking an increase of about 14.3% compared to 2022.

- Growth by Destination: The British Virgin Islands saw the highest increase in arrivals at 85.1%, followed by Curaçao at 60.5%, and Barbados at 51%.

- Cruise Visits Record: The region recorded an estimated 31.1 million cruise visits in 2023, reflecting an increase of about 56.8% compared to 2019.

Future Projections

- Projected Growth for 2024: Anticipated growth is forecasted to range between 5% and 10%, potentially welcoming between 33.8 million and 35.4 million stay-over tourists by the end of 2024.

- Cruise Sector Expectations: The cruise sector is expected to see between 34.2 million and 35.8 million cruise visits in 2024, continuing its upward trend.

Miscellaneous Visitor Insights

- Visitor Age Demographics: A significant portion of visitors (approximately 40%) are aged between 25 and 44 years old, indicating a youthful demographic that is crucial for future tourism growth.

- Length of Stay: The average length of stay for tourists in the Caribbean is about 7 days, which supports local economies through extended spending on accommodations and activities.

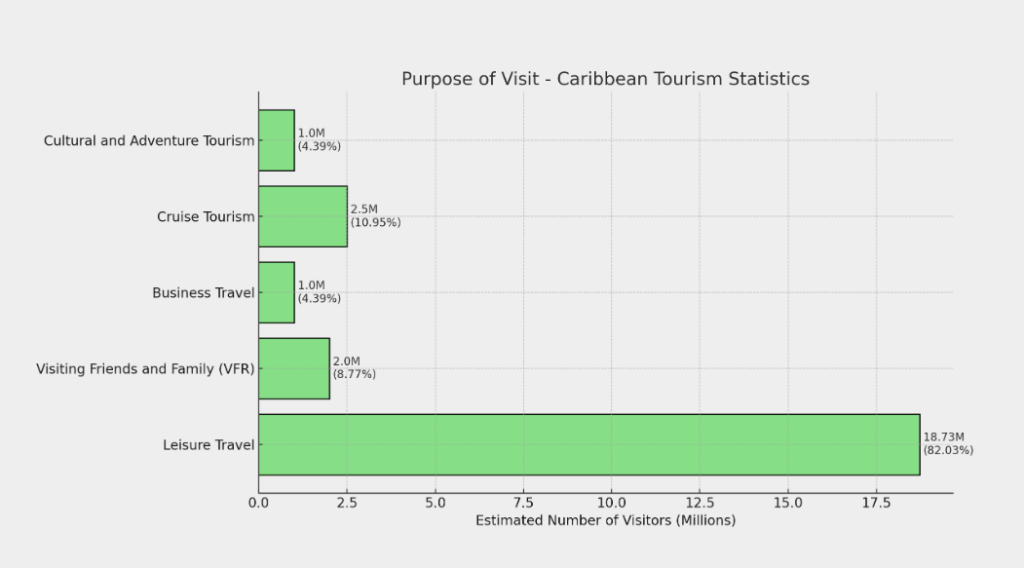

Types of Tourism

- Preferred Holiday Types: Sun and beach holidays were the most popular type of vacation in the Caribbean, dominating the market share.

- Adventure Tourism Growth: There is a rising interest in adventure tourism, which includes activities like hiking and water sports.

Related: 100+ Top Statistics and Facts About Traveling: Trends and Insights

Economic Impact and Visitor Expenditure

GDP Contribution

- Travel and Tourism Contribution: Travel and tourism contribute approximately 14.8% to the Caribbean’s total GDP, expected to rise to around 16.5% by 2024 according to Macrotrends.

- Regional Growth: In 2023, the combined contribution of travel and tourism to the GDP in Latin America and the Caribbean amounted to approximately $714 billion, with a forecasted growth of 3.9% for 2024.

Employment Generation

- Tourism Employment: The tourism sector generates about 15.5% of total employment, projected to increase to 17.1% by 2024.

- Job Creation: In 2023, the Caribbean tourism sector created an estimated 1.2 million jobs, reflecting a significant recovery from pandemic-related job losses.

| Year | Total Employment in Tourism (Million) | Percentage Change from Previous Year |

|---|---|---|

| 2013 | 2.21 | – |

| 2014 | 2.33 | +5.4% |

| 2015 | 2.45 | +5.1% |

| 2016 | 2.56 | +4.5% |

| 2017 | 2.67 | +4.3% |

| 2018 | 2.78 | +4.1% |

| 2019 | 2.94 | +5.8% |

| 2020 | 2.18 | -25.8% |

| 2021 | 2.50 | +14.7% |

| 2022 | 2.82 | +12.8% |

| 2023 | 3.00 | +6.4% |

Visitor Expenditure Growth

- Visitor Spending Increase: Total visitor expenditure has been growing at an average rate of about 7.2% per annum, outpacing global averages.

- Cruise Tourism Expenditure: Cruise tourism generated approximately $4.27 billion in direct expenditures, about 27% higher than the previous record set in 2018.

- Average Daily Spending: Visitors to the Caribbean spend an average of around $150 per day, which includes accommodation, food, activities, and shopping.

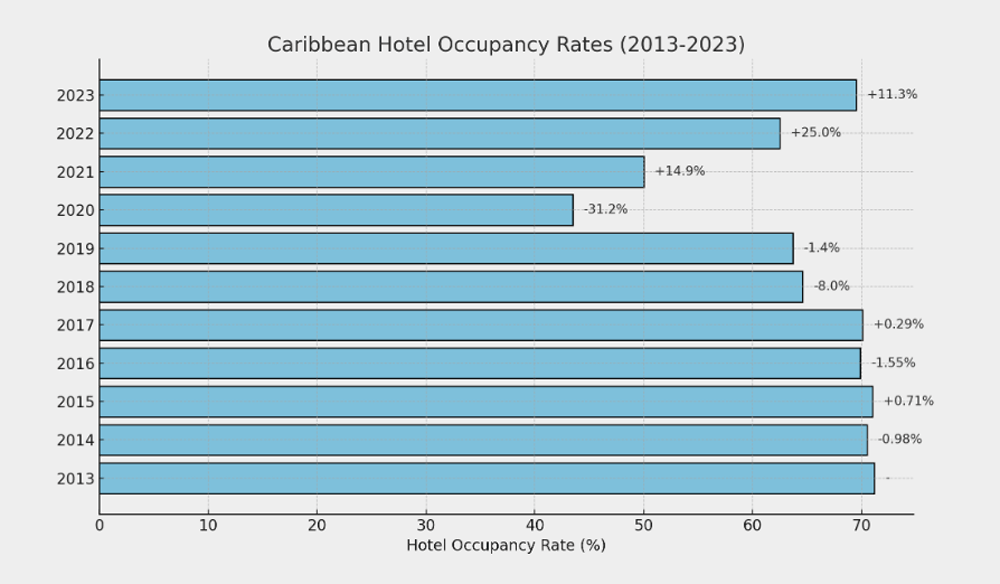

Hotel Performance Metrics

| Year | Hotel Occupancy Rate (%) | Percentage Change from Previous Year |

|---|---|---|

| 2013 | 71.2 | – |

| 2014 | 70.5 | -0.98% |

| 2015 | 71.0 | +0.71% |

| 2016 | 69.9 | -1.55% |

| 2017 | 70.1 | +0.29% |

| 2018 | 64.6 | -8.0% |

| 2019 | 63.7 | -1.4% |

| 2020 | 43.5 | -31.2% |

| 2021 | 50.0 | +14.9% |

| 2022 | 62.5 | +25.0% |

| 2023 | 69.5 | +11.3% |

- Hotel Occupancy Rates: The Caribbean hotel sector experienced a remarkable turnaround in 2023, with average room occupancy growing to 65.6%, up from 61% in 2022.

- Average Daily Rate (ADR): The ADR for hotels reached approximately $329.37, marking an increase of 11.8% from the previous year.

- Revenue per Available Room (RevPAR): RevPAR jumped by 20.2% to approximately $215.97, indicating robust demand for accommodations in the region.

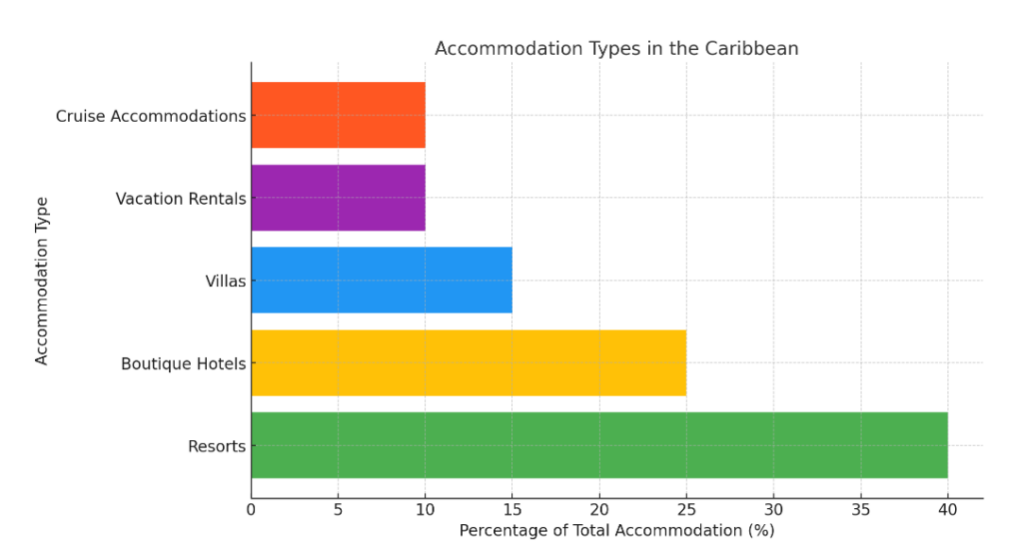

Accommodation

Caribbean Hotel Room Capacity (2013-2024)

| Year | Total Hotel Rooms (Approx.) | Notes |

|---|---|---|

| 2013 | 250,000 | Pre-pandemic levels. |

| 2014 | 252,000 | Stable growth. |

| 2015 | 255,000 | Continued increase. |

| 2016 | 258,000 | Gradual growth. |

| 2017 | 260,000 | Slight increase. |

| 2018 | 265,000 | Growth in inventory. |

| 2019 | 290,000 | Peak before pandemic. |

| 2020 | 270,000 | Decrease due to pandemic closures. |

| 2021 | 260,000 | Continued impact of COVID-19. |

| 2022 | 275,000 | Gradual recovery as hotels reopened. |

| 2023 | 280,038 | Improvement in occupancy and room inventory 1. |

| 2024 (Projected) | ~290,000 | Expected increase in new projects and room capacity 1. |

- Accommodation Capacity: By the end of 2000, the Caribbean had an accommodation capacity of approximately 252,500 rooms, reflecting a growth of over 24% since 1994 (TravelPulse).

- Hotel Occupancy Rates: In 2023, average hotel occupancy rates reached about 65.6%, up from 61% in 2022 (TravelPulse).

Future Projections

- Cruise Sector Growth Forecasts: The cruise sector is expected to see between 34.2 million and 35.8 million cruise visits in 2024, representing a continued upward trend (Caribbean Tourism Organization).

- Long-Stay Tourist Arrivals Growth Rate: Long-stay tourist arrivals have grown at an average rate of about 2.5% from 1989 to 2014, slower than global averages but still significant (Macrotrends).

Challenges and Opportunities

- Market Competition: The Caribbean faces increasing competition from other regions, impacting long-stay tourist growth rates compared to cruise arrivals which have tripled in some areas (One Caribbean).

- Sustainable Tourism Focus: There is a growing emphasis on sustainable tourism practices within the industry to mitigate environmental impacts while enhancing visitor experiences (TravelPulse).

FAQ

What are the top attractions in the Caribbean?

The Caribbean is home to numerous stunning attractions. Some of the top highlights include:

- Dunn’s River Falls, Jamaica: A famous waterfall where visitors can climb the limestone tiers.

- The Baths, Virgin Gorda: Unique geological formations with hidden pools and stunning beaches.

- Morne Trois Pitons National Park, Dominica: A UNESCO World Heritage site featuring volcanic landscapes and hiking trails.

- Stingray City, Grand Cayman: An opportunity to swim and interact with friendly stingrays in shallow waters.

- Gros Piton, St. Lucia: A challenging hike offering breathtaking views from the summit.

- Arikok National Park, Aruba: A diverse natural landscape ideal for hiking and exploring unique ecosystems.

How has Caribbean tourism evolved over the past decade?

Caribbean tourism has seen significant changes over the last decade:

- Recovery from Crises: The region has rebounded from natural disasters and the COVID-19 pandemic, with visitor numbers steadily increasing.

- Diversification of Offerings: There has been a shift towards eco-tourism and adventure travel, alongside traditional sun-and-beach vacations.

- Increased Competition: The Caribbean faces competition from other tropical destinations, prompting countries to enhance their tourism offerings and marketing strategies.

- Sustainability Focus: More emphasis is being placed on sustainable tourism practices to protect the region’s natural beauty and cultural heritage.

Which Caribbean countries have the highest tourism revenue?

Several Caribbean nations generate significant tourism revenue:

- Dominican Republic: The largest tourist destination in the Caribbean, known for its resorts and diverse attractions.

- Cuba: Attracts millions of visitors annually, particularly for its cultural experiences and historical sites.

- Jamaica: Renowned for its beaches, music scene, and all-inclusive resorts.

- Bahamas: Popular for luxury tourism and cruise ship visits, contributing significantly to its economy.

What are the main challenges facing Caribbean tourism?

The Caribbean tourism sector faces several challenges:

- Natural Disasters: Hurricanes and other natural events can disrupt travel and damage infrastructure.

- Economic Vulnerability: Many islands rely heavily on tourism, making them susceptible to global economic fluctuations.

- Environmental Concerns: Over-tourism can lead to environmental degradation, prompting calls for sustainable practices.

- Competition from Other Destinations: Increased competition from other regions necessitates innovation in offerings and marketing strategies.

How do different types of tourism (sun and beach, VFR, etc.) impact the Caribbean economy?

Different types of tourism play distinct roles in shaping the Caribbean economy:

- Sun and Beach Tourism: This is the dominant form of tourism, driving significant revenue through hotel stays, dining, and activities. It supports local employment in hospitality sectors.

- Visiting Friends and Relatives (VFR): This type fosters cultural exchange and supports local economies through spending on accommodations and food. It often leads to repeat visits from diaspora communities.

- Adventure and Eco-Tourism: Growing interest in these areas promotes conservation efforts while diversifying income sources beyond traditional beach tourism. This shift helps mitigate risks associated with reliance on a single type of visitor.

This blog post may contain affiliate links. If you click on one and make a purchase, I may earn a small commission at no extra cost to you.